IN HER statement made on 10th July, regarding future funding of Canal & River Trust, Dr Thérèse Coffey, Secretary of State for Environment, Food and Rural told:

“Since it was first created in 2012, as a private charity independent of government, we have been very clear that the Trust would have to increasingly move towards alternative sources of funding. We have been discussing this with the charity for some time and have been offering support on how it can increase income from other sources, alongside continued government funding, which countless charities across the country do very effectively.”

Allan Richards takes a look at the three sources of income that comprise CaRT’s £1.14 billion of investment assets and finds performance far below that agreed with government.

Gross and net

According to CaRT’s 2021/22 Annual Report, it has investment assets of £1.14 billion. “These investments generated £51.4m of income to spend on charitable activities” according to page 82 of the report with the same figure repeated multiple times.

However, CaRT’s claim is totally misleading as it relates to gross income and does not take into account expenditure on raising this income. This can be found on page 134 on the lines “Investment and property income” (“£11.3m) and “Interest Payable” (£4.4m).

Net income from CaRT’s £1.14 billion assets is just £33.6m and it is this sum, not £51.4m, which can be spent on charitable activities, including maintaining CaRT’s waterways.

Cart’s £1.14 billion of assets produced a net return of less than 3% in 2021/22.

Projected vs actual

In 2012, KPMG produced a report detailing projected net income for CaRT’s income streams up until 2027. This was agreed by both CaRT's transition trustees and government as being a reasonable indication that the trust was viable and could reduce its dependence on grant whilst closing a substantial funding gap.

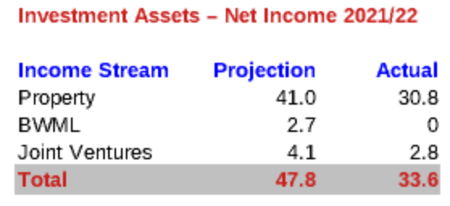

Here is given the 2021/22 projected and actual income streams that make up CaRT’s investment assets. BWML shows as zero as it was sold off and the proceeds used to buy other assets.

Here is given the 2021/22 projected and actual income streams that make up CaRT’s investment assets. BWML shows as zero as it was sold off and the proceeds used to buy other assets.

Borrowed £150m

Over the last ten years or so, CaRT has diversified its property income stream to include non property assets. It has also borrowed £150m to buy more assets.

However, the fact remains that net income is a staggering £14.2m (or 30%) down on where it should be.

Little wonder government says it has given CaRT advice as to how it can improve its income ...

... and it is understood that the unpublished 2022/23 Annual Report will hide even worse results.